All Categories

Featured

[/image][=video]

[/video]

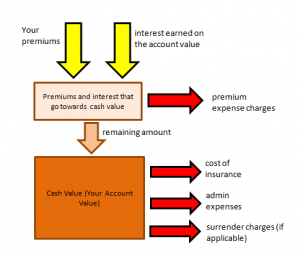

Withdrawals from the money worth of an IUL are normally tax-free up to the quantity of premiums paid. Any withdrawals over this quantity might be subject to tax obligations depending on plan framework.

Withdrawals from a Roth 401(k) are tax-free if the account has actually been open for at the very least 5 years and the person mores than 59. Properties withdrawn from a traditional or Roth 401(k) prior to age 59 may incur a 10% fine. Not specifically The insurance claims that IULs can be your own financial institution are an oversimplification and can be misinforming for lots of factors.

Nevertheless, you might be subject to upgrading associated health and wellness concerns that can influence your recurring prices. With a 401(k), the cash is always your own, including vested company matching regardless of whether you give up adding. Risk and Warranties: Firstly, IUL plans, and the cash worth, are not FDIC insured like conventional checking account.

While there is generally a floor to avoid losses, the growth possibility is covered (indicating you might not fully take advantage of market upswings). A lot of experts will certainly concur that these are not similar items. If you desire survivor benefit for your survivor and are concerned your retired life cost savings will not suffice, after that you may desire to consider an IUL or other life insurance policy product.

Certain, the IUL can give access to a money account, however once more this is not the main purpose of the product. Whether you desire or require an IUL is an extremely private concern and relies on your primary financial objective and objectives. Nevertheless, below we will certainly try to cover benefits and limitations for an IUL and a 401(k), so you can even more delineate these products and make an extra educated decision pertaining to the finest method to handle retirement and caring for your loved ones after fatality.

Fixed Index Universal Life Insurance Policy

Funding Costs: Financings against the plan accumulate rate of interest and, if not paid back, decrease the fatality benefit that is paid to the recipient. Market Participation Limitations: For most plans, investment growth is connected to a supply market index, however gains are typically topped, limiting upside prospective - iul sales. Sales Practices: These plans are frequently sold by insurance policy agents that might highlight benefits without totally describing expenses and risks

While some social media pundits recommend an IUL is an alternative product for a 401(k), it is not. These are various items with various objectives, functions, and expenses. Indexed Universal Life (IUL) is a type of permanent life insurance policy plan that also provides a cash value part. The cash value can be utilized for numerous purposes consisting of retirement cost savings, additional earnings, and other economic needs.

Latest Posts

Iul Sales

Single Premium Indexed Universal Life Insurance

A Quick Guide To Understanding Universal Life Insurance